Hong Kong Main

Board Listing

Stock Code: 2283

Holds 2020 Annual Results Conference Call

* * *

Revenue at HK$2.03 Billion and Profit at HK$210 Million Despite COVID-19 Challenges

Final Dividend of HK8.0 Cents, Full-year Payout Ratio at 39.7%

Order Book Reaches HK$930 Million with Continued Growth Momentum in Second Half

[Hong Kong - March 29, 2021] The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283), today announces its annual results for the year ended 31 December 2020 (the "Year") at an investor conference. Due to the pandemic, the conference is held via conference call, still attracting active participation and questions from numerous fund managers and analysts.

In the first half of 2020, impacted by the novel coronavirus pneumonia ("COVID-19") pandemic, the Group's major clients postponed most orders, affecting the Group's interim performance. In contrast, during the second half, China's pandemic control measures proved effective and economic activities accelerated recovery. Although the overseas pandemic situation remained volatile, markets gradually adapted to the new normal under the pandemic, leading multiple downstream clients to resume new product development and market launch plans. This enabled the Group's second-half revenue to return to levels comparable with the same period last year. The Group's revenue for 2020 reached HK$2,033.4 million (2019: HK$2,310.8 million), representing a 12.0% decrease year-on-year.

During the Year, affected by the pandemic, multiple countries implemented quarantine and social restriction measures impacting daily operations. The Group's clients delayed delivery dates and new orders, leading to increased machine idle time in the first half. Additionally, since the intensification of the US-China trade war in 2019, intense industry competition led to lower prices for molds delivered during the Year, affecting overall gross profit margin. Gross profit margin decreased by 2.7 percentage points to 26.2% (2019: 28.9%). Profit attributable to owners of the Company was HK$209.7 million (Full year 2019: HK$301.8 million), representing a 30.5% decrease year-on-year. Net profit margin was 10.3% (Full year 2019: 13.1%), representing a decrease of 2.8 percentage points year-on-year, with basic earnings per share at HK$0.25 (2019: HK$0.36), representing a 30.6% decrease year-on-year. The Board has resolved to recommend the payment of a final dividend of HK8.0 cents per share for the year ended 31 December 2020. Together with the interim dividend of HK2.0 cents per share already paid, the payout ratio reaches 39.7%.

Outlook

Looking ahead to 2021, as multiple COVID-19 vaccines begin distribution across many countries globally, global consumer confidence and willingness are expected to gradually stabilize. Consumer demand will drive the recovery of product demand from the Group's clients, thereby boosting the Group's order volume growth. Over the past two years, the Group has successfully developed the electronic vaporizer components segment and, through excellent product quality, has secured orders from several international and Chinese renowned clients. With rising global demand for electronic vaporizers, TK Group believes this segment has broad growth prospects. In 2021, TK Group will focus on maintaining its diversification strategy, enhancing intelligent automation levels and technological development of existing production lines to maintain competitive advantages and profitability, and standing firm in an ever-changing market while seeking opportunities for sustained growth.

Mr. Li Pui Leung, Chairman of TK Group, said, "The Group restarted establishing an injection molding production base in Vietnam at the end of 2020, expecting to complete production line installation in the third quarter of 2021 and commence production in the fourth quarter, extending regional coverage in line with supply chain migration to reduce long-term geopolitical risks. Additionally, the Group will expand production at three production bases in Shenzhen Guangming District headquarters, Huizhou, and Suzhou, expecting gradual implementation from 2021 to match rising order volumes, preparing for long-term order growth demand." He added, "Facing numerous uncontrollable macro factors such as possible pandemic resurgence and geopolitical issues, the Group will continue maintaining a prudent approach and strict credit and trade receivables turnover policies to stabilize cash flow and financial position, building a more solid foundation for long-term business development."

Mr. Yung Kin Cheung Michael, Executive Director and Chief Executive Officer of TK Group, added, "The Group has sufficient orders on hand, reaching HK$925.2 million as of December 31, 2020. The Group's orders and production plans in the first quarter of 2021 maintain the momentum from the second half of 2020, and we believe production line utilization will significantly improve in the first half of 2021. Furthermore, the Group continues to develop more client bases in China's consumer goods market to expand domestic market share, including actively seeking cooperation with more important brands in high-tech consumer electronics products and medical supplies, maintaining the strategic direction of developing diversified clients to balance risks from different segment and market fluctuations."

Mr. Li Pui Leung (left), Chairman of TK Group, and Mr. Yung Kin Cheung Michael (right), Chief Executive Officer

Business Review for the Full Year 2020

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises. During the Year, downstream client segments including medical and personal care, automotive, and mobile and wearable device segments still recorded growth.

Plastic Components Manufacturing Business (Approximately 65.6% of Total Revenue)

In 2020, revenue from the medical and personal care segment increased by 7.0% year-on-year. The Group added several sizeable new clients during the Year, including an overseas brand client in the medical consumables industry and a domestic listed company, with multiple sets of molds successfully customized during the Year, expecting related injection molding components to enter mass production in 2021. Revenue from the mobile and wearable device segment increased by 3.7% year-on-year, primarily due to significant order growth driven by market popularity of new products launched by smartphone protective case brand clients in line with new smartphone models. Additionally, wireless earphone brand clients' products remained popular despite the pandemic impact, recording order growth during the Year. Furthermore, due to the Group's excellent product quality and reputation in the industry, the Group successfully added another North American smart home brand client during the Year, now serving three industry giants, giving the Group strong confidence in this segment's long-term development.

Overall revenue from the plastic components manufacturing business was approximately HK$1,333.2 million (2019: HK$1,720.0 million), representing a 22.5% decrease year-on-year. Gross profit margin of the plastic components business slightly decreased to 25.6% (2019: 26.7%), mainly due to severe pandemic impact in the first half with certain projects delaying production, leading to increased machine idle time. As related projects and new client projects progressively commenced, machine utilization returned to stable mass production in the second half, bringing the Group's overall annual gross profit margin back to healthy levels.

Mold Fabrication Business (Approximately 34.4% of Total Revenue)

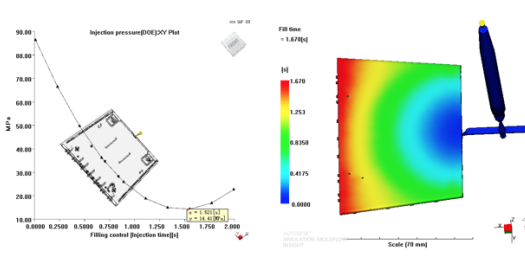

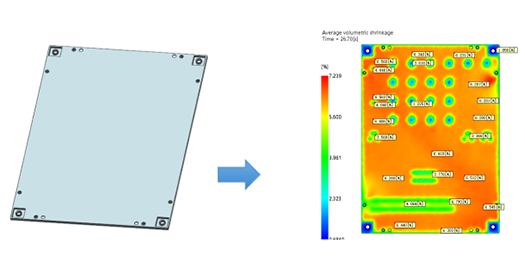

The Group's ultra-large standard molds mainly produce automotive components, primarily serving tier-one component suppliers for European automotive brands such as Mercedes-Benz, BMW, and Volkswagen. The precision mold production line mainly focuses on producing multi-cavity and high-efficiency precision molds, serving markets including smart home, mobile and wearable devices and other high-end consumer electronics, commercial communication equipment, and medical and personal care industries, complementing downstream plastic components manufacturing business to provide better one-stop services for clients.

In 2020, revenue from the mold fabrication business was approximately HK$700.2 million, representing an increase of approximately 18.5% from approximately HK$590.8 million in the previous year. With increasingly intense competition in the mold manufacturing industry and instability factors from the US-China trade war, the Group inevitably faced pricing pressure from clients and fierce competition from overseas peers, resulting in lower prices. Gross profit margin decreased by 7.8 percentage points year-on-year to 27.4% (2019: 35.2%). However, the Group has been vigorously developing new clients and products over the past few years. During the Year, increased mold delivery volume in the medical and personal care segment led to a 165.5% year-on-year increase (approximately HK$108.6 million) in segment revenue, driving mold business growth. Facing industry competition, the Group will continue to enhance its technical capabilities and production efficiency while expanding into other high-value-added mold categories, providing high-quality molds and design solutions for clients to improve gross profit margin and maintain the Group's absolute quality and technical advantages in the industry.