Hong Kong Main

Board Listing

Stock Code: 2283

* * *

Revenue Reaches HK$1.02 Billion, Profit Exceeds HK$115 Million

Interim Dividend of HK5.4 Cents, Payout Ratio at 39.1%

Order Book Reaches HK$1.07 Billion

Strong Growth Recorded Across Multiple Segments

Further Domestic Sales Expansion in Second Half

[Hong Kong - August 16, 2021] The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283), today announces its interim results for the six months ended 30 June 2021 (the "Period").

Looking back at the first half of 2021, the global economy maintained its recovery momentum amid fluctuations. With COVID-19 coming under control in European and American economies, related control measures were gradually relaxed, economic activities progressively returned to normal, and consumption recovery accelerated. China's production side largely returned to pre-pandemic levels, and the Group's orders and production volume also recovered to levels comparable with 2019. In the first half of 2021, the Group's revenue was HK$1,020.8 million (1H 2020: HK$729.4 million), representing a 40.0% increase year-on-year.

During the Period, with capacity utilization improving compared to the same period last year due to robust orders, the Group's gross profit was HK$242.3 million (1H 2020: HK$162.5 million), representing a 49.1% increase year-on-year, with gross profit margin increasing by 1.4 percentage points to 23.7% (1H 2020: 22.3%). Compared to the same period in 2019, initial costs for new products and raw material price fluctuations in the first half of 2021 inevitably affected overall gross profit margin performance. However, raw material price fluctuations eased after May, and with new projects moving past their adjustment period, production efficiency will improve, suggesting potential for continued gross margin improvement in the second half. The Group recorded profit attributable to owners of the Company of HK$115.2 million (1H 2020: HK$41.4 million), representing a substantial increase of 178.5% year-on-year, basically reaching parity with the same period in 2019. Net profit margin was 11.3% (1H 2020: 5.7%), representing an increase of 5.6 percentage points year-on-year, with basic earnings per share at HK13.9 cents (1H 2020: HK5.0 cents).

The Board has resolved to recommend the payment of an interim dividend of HK5.4 cents per share for the six months ended 30 June 2021, representing a payout ratio of 39.1%.

Outlook

As European and American countries ease pandemic restrictions amid improving situations, the global economy continues to rise. Looking ahead to the second half of the year, the Group expects economic growth to further accelerate, driving consumer demand. In Asian countries experiencing new virus variants and rising cases, the pandemic remains a significant threat to economic growth. Facing volatile economic conditions, management maintains a prudent approach. Long-term stable cash flow and healthy financial position lay a solid foundation for long-term business development, enabling the Group to overcome challenges and advance steadily in a volatile market.

Mr. Li Pui Leung (right), Chairman of TK Group, and Mr. Yung Kin Cheung Michael (left), Chief Executive Officer

Mr. Li Pui Leung, Chairman of TK Group, said, "Last year, the Group established its first five-year development plan, setting a target to double sales in both precision mold and injection molding segments within five years. We are confident in achieving this target as planned. As of June 30, 2021, the Group's order book reached HK$1,065.0 million, with the record-high order amount and multiple segments outperforming 2019 levels demonstrating the achievability of the Group's five-year plan. With sufficient injection molding product orders and technical advantages in molds, we believe there is enormous potential for overall business growth." He added, "The Group's overseas injection molding facility in Vietnam is expected to commence mass production this year, with injection molding capacity in Southeast Asia complementing client demand and preparing for future new projects."

Mr. Yung Kin Cheung Michael, Chief Executive Officer of TK Group, added, "The Group has been actively identifying acquisition targets and will focus on seeking suitable opportunities within downstream clients' supply chains this year, seizing business development opportunities to expand our business territory. Client diversification remains the Group's consistent strategy, and in the second half of the year, TK Group will continue developing new clients, striving to provide quality products for brand clients. Additionally, the Group continues to advance its internal development and external expansion strategy, further expanding domestic sales this year to diversify geographical risks."

Business Review for the First Half of 2021

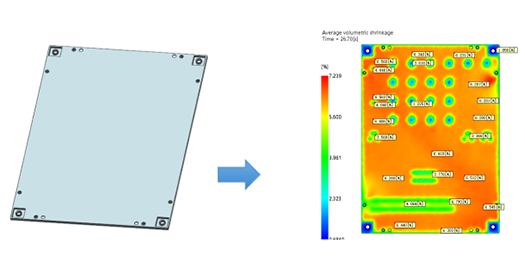

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises. During the Period, mobile and wearable device, automotive, medical and personal care, smart home, and commercial communication equipment segments recorded strong growth, while the new electronic vaporizer segment also showed outstanding performance.

Revenue from the mobile and wearable device segment increased by 31.4% year-on-year and 16.0% compared to the same period in 2019, driven by significant order growth from wireless earphone brand clients and smartphone case brand clients. The medical and personal care segment maintained steady demand growth, with revenue increasing by 34.0% year-on-year. During the Period, the Group added several renowned domestic and international medical brand clients, covering areas including in-vitro diagnostics, blood glucose monitoring, and immunoassay, with related injection molding components entering mass production in the second half. Smart home segment revenue surged by 67.4% year-on-year and increased by 12.8% compared to the same period in 2019, attributed to new projects from a newly added leading North American smart home brand client entering production during the Period. Commercial communication equipment segment revenue increased by 55.2% year-on-year. While clients' traditional products approached market saturation, their transformation strategy has been gradually implemented, successively launching other commercial product lines, such as commercial headphone products in North America. Benefiting from long-term stable client relationships, the Group remains the main supplier for clients' new products, with sufficient orders for the second half and expected continued sales rebound for the full year. After more than a year's effort, the new electronic vaporizer segment showed significant revenue growth, making a notable contribution to the Group with revenue increasing by 215.9% year-on-year.

Plastic Components Manufacturing Business (Approximately 64.2% of Total Revenue)

Overall revenue from the plastic components manufacturing segment was approximately HK$655.3 million (1H 2020: HK$457.8 million), representing a 43.1% increase year-on-year. In the first half of 2021, with reduced machine idle time, gross profit margin of the plastic components manufacturing business increased by 1.6 percentage points to 20.5% from approximately 18.9% in the same period last year. The Group expects gross margin to improve in the second half as a number of new projects enter stable mass production phase, along with sufficient orders on hand leading to significantly improved capacity utilization.

Mold Fabrication Business (Approximately 35.8% of Total Revenue)

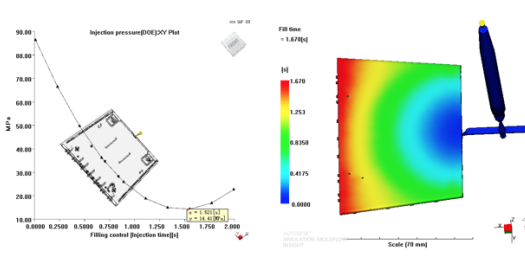

The Group's ultra-large standard molds mainly produce automotive components, primarily serving tier-one component suppliers for European automotive brands such as Mercedes-Benz, BMW, and Volkswagen. The precision mold production line mainly focuses on producing multi-cavity and high-efficiency precision molds, serving markets including smart home, mobile and wearable devices and other high-end consumer electronics, commercial communication equipment, and medical and personal care industries, complementing downstream plastic components manufacturing business to provide better one-stop services for clients.

In the first half of 2021, revenue from the mold fabrication business was approximately HK$365.5 million, representing an increase of approximately 34.6% from approximately HK$271.6 million in the same period last year. Due to international shipping issues causing last year's orders to be delayed to this year's first half for delivery, the mold segment revenue showed significant growth compared to the same period last year, with segment gross profit margin increasing by 1.7 percentage points to 29.6%.