Hong Kong Main

Board Listing

Stock Code: 2283

* * *

Revenue Exceeds HK$970 Million, Profit Reaches HK$58.5 Million

Interim Dividend of HK2.8 Cents, Payout Ratio at 39.9%

Order Book Reaches HK$1.0 Billion with Diversified Product Portfolio

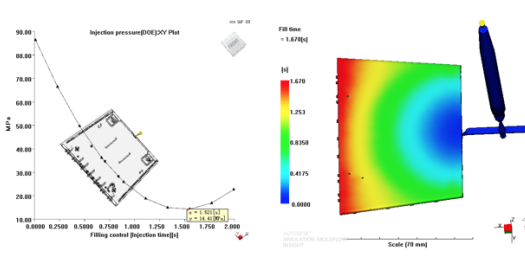

Continuing to Advance Five-Year Plan to Double Injection Molding Business Sales

The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283), today announces its interim results for the six months ended 30 June 2022 (the "Period").

In the first half of 2022, new virus variants, international situations including US-China relations and the Russia-Ukraine conflict, along with global inflation expectations hampered global economic recovery, severely affecting client order volumes. Combined with ongoing semiconductor shortages hindering normal production plans, the Group's performance was impacted. In the first half of 2022, the Group's revenue was HK$969.2 million, representing a 5.1% decrease year-on-year, with mold fabrication business declining by 32.4% due to automotive supply chain disruptions, while plastic components manufacturing business recorded 10.2% growth.

With semiconductor shortages remaining unresolved, major automotive manufacturers and electronics producers reduced output. Additionally, after Russia launched military action against Ukraine in the first half of the year, global market turbulence triggered rapid increases in energy and commodity prices, driving up production costs and further pushing global inflation. Economic fluctuations and high inflation expectations led electronics consumer goods clients to become more conservative, frequently adjusting orders and delivery schedules. The Group had to adjust normal production arrangements accordingly, affecting production efficiency and gross profit margin. The Group's gross profit decreased by 25.3% to HK$180.9 million (1H 2021: HK$242.3 million). Gross profit margin decreased by 5.0 percentage points to 18.7% (1H 2021: 23.7%). Profit attributable to owners of the Company was HK$58.5 million, representing a decrease of approximately 49.3% year-on-year. Net profit margin decreased by 5.3 percentage points to 6.0% (1H 2021: 11.3%), with basic earnings per share at HK7.0 cents, representing a 49.6% decrease year-on-year.

Based on stable cash flow conditions, the Board has resolved to recommend the payment of an interim dividend of HK2.8 cents per share for the six months ended 30 June 2022, representing a payout ratio of 39.9%.

Outlook

For the second half of 2022, global inflation is expected to remain high, creating pressure on economic growth. However, the Group believes that overall business environment volatility will be lower than in the first half, facilitating normal development. Facing various macroeconomic challenges, the Group will continue to forge ahead, implementing cost control measures, advancing process optimization and automation, enhancing organizational agility, and improving operational efficiency. Meanwhile, leveraging its strengths, the Group actively extends its value chain, enhances comprehensive competitiveness, develops more client sources, and maintains the competitive advantage of a diversified client base, laying a foundation for long-term stable business development and maximizing value for clients and shareholders.

Mr. Li Pui Leung, Chairman of TK Group, said, "The Group remains optimistic about our five-year plan to double injection molding business sales. As for the mold business segment, the Group will vigorously develop precision mold business. TK possesses production capabilities for the highest precision MT1 molds and will invest additional resources to enhance technology based on existing precision levels. Currently, our precision molds have gained recognition and attention from mainland clients, establishing a solid foundation for future expansion in the mainland market." He added, "The Group plans to launch the second phase of our Vietnam production base in the second half of 2022, expanding capacity to help develop new clients from Southeast Asia and Europe/America."

Mr. Yung Kin Cheung Michael, Chief Executive Officer of TK Group, added, "The Group has been developing new products that integrate silicone and traditional injection molding technologies to provide clients with more diverse product designs. Given growing client demand for silicone products, we will lease new factory space in Huizhou in 2022 to further integrate production lines and improve production capacity and efficiency. The Group has significant advantages in producing high-tech product casings and has engaged with several industry giants to develop new metaverse-related products. Additionally, management maintains an active approach to acquisition plans, continuously seeking suitable targets with development potential. Besides considering acquisitions within the industry, the Group also seizes opportunities to participate in entirely new areas of development, keeping pace with the times to maintain long-term competitive advantages."

Business Review for the First Half of 2022

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises. During the Period, the mobile and wearable device, medical and personal care, and commercial communication equipment segments maintained stable growth, while the smart home and electronic vaporizer segments showed particularly impressive performance. The mobile and wearable device and medical and personal care segments maintained stable growth, increasing by 2.0% and 1.1% year-on-year respectively. During the Period, wireless earphone brand clients and smartphone case brand clients maintained growing demand, with innovative product solutions incorporating silicone contributing to this success. The Group developed several new domestic and international medical sector clients, effectively offsetting reduced product orders from personal care brand clients due to semiconductor supply shortages. Focusing on serving two global leading smart home brand clients, who initiated mass production of multiple products during the Period with robust orders, the Group's smart home segment revenue increased by 25.3% year-on-year. Benefiting from long-term stable relationships with commercial communication equipment clients, the Group remained a major supplier following clients' transformation, with segment revenue increasing by 13.7% year-on-year and new products achieving strong sales. Additionally, with the overseas electronic cigarette market flourishing, the Group primarily served overseas brand clients, gaining recognition for its technology and achieving continuous business development, with revenue increasing by 57.4% year-on-year.

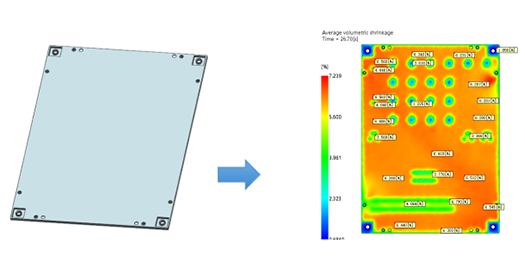

Plastic Components Manufacturing Business (Approximately 74.5% of Total Revenue)

Revenue from the plastic components manufacturing business was approximately HK$722.0 million, representing a 10.2% increase year-on-year. In the first half of 2022, gross profit margin decreased to 17.3% (1H 2021: 20.5%), primarily due to frequent order adjustments affecting production efficiency, along with the Group's more aggressive business strategy of increasing self-funded mold investments. The Group expects semiconductor shortages to ease in the second half, improving order stability and potentially gross profit margin, achieving sustainable long-term development in the injection molding segment.

Mold Fabrication Business (Approximately 25.5% of Total Revenue)

In the first half of 2022, revenue from external customers of the mold fabrication business was approximately HK$247.2 million, representing a decrease of approximately 32.4% from approximately HK$365.5 million in the same period last year. Given semiconductor market supply shortages and component scarcity, automotive manufacturers were forced to lower production targets, affecting standard mold order demand and increasing equipment idle time. Combined with euro depreciation pressure, segment gross profit margin decreased by 7.0 percentage points to 22.6%. Amid increasingly intense market competition, the Group is improving standard mold profit margins through cost reduction and efficiency enhancement while actively developing new clients and projects for precision molds, focusing on medical, consumer electronics, and packaging industries to develop top-tier client bases in related industries. The Group continues to enhance precision mold accuracy, with its excellent technical quality gaining popularity and recognition from mainland clients.