Hong Kong Main

Board Listing

Stock Code: 2283

TK Group (Holdings) Limited

(Stock Code: 2283)

Announces 2024 Interim Results

* * *

Revenue Reaches HK$1.01 Billion, Profit Increases 45.8% to HK$79.7 Million

Interim Dividend of HK4 Cents, Payout Ratio at 41.8%

Strong Business Rebound with Robust Order Book, Gross Profit Margin Up 1.5 Percentage Points to 24.8%

Expected Growth in Consumer Product Demand, Deepening Cooperation with Major Consumer Electronics Brands

The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283) announces its interim results for the six months ended 30 June 2024 (the "Period").

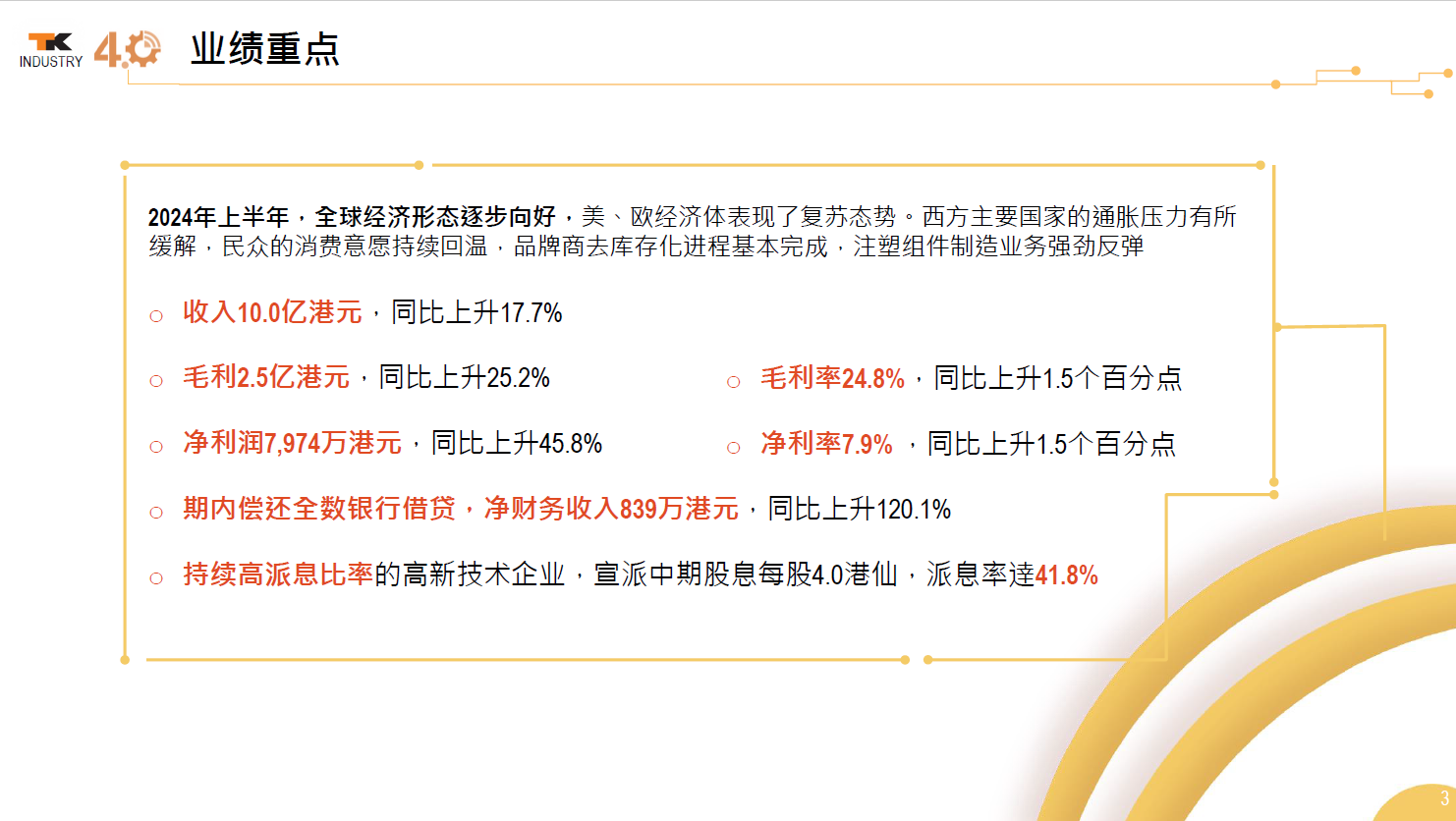

In the first half of 2024, the global economy showed gradual improvement, with inflationary pressures easing in major Western countries and consumer sentiment continuing to recover. Brand manufacturers have largely completed their destocking process, and with the cyclical recovery of the consumer electronics industry, orders from consumer electronics customers have begun to rebound. Additionally, following a round of industry consolidation on the supply side, a pattern of survival of the fittest has emerged, allowing capable enterprises to secure larger supply shares. In the first half of 2024, the Group's revenue reached HK$1,007.2 million (1H 2023: HK$855.9 million), representing a year-on-year increase of 17.7%. The mold fabrication business maintained steady growth, while the plastic components manufacturing business showed a strong rebound, with particularly impressive performance in downstream sectors such as mobile and wearable devices, and commercial communication equipment.

During the Period, owing to sufficient orders, capacity utilization saw a significant increase compared to the same period last year. Combined with the Group's ongoing comprehensive optimization and improvement of production processes and implementation of cost reduction and efficiency enhancement measures, the Group's gross profit increased by 25.2% to HK$250.0 million (1H 2023: HK$199.7 million), with gross profit margin rising by 1.5 percentage points to 24.8% (1H 2023: 23.3%). As new projects gradually move past their initial investment period, production efficiency is expected to further improve, with gross profit margin performance continuing to enhance in the second half of the year. In the first half of 2024, the Group maintained strict control over administrative expenses, with administrative expenses as a percentage of revenue decreasing to 13.5% (1H 2023: 14.7%). Meanwhile, the Group repaid all bank loans and conducted prudent financial management, resulting in a 120.1% increase in net finance income to HK$8.4 million. Profit attributable to owners of the Company increased significantly by 45.8% year-on-year to HK$79.7 million (1H 2023: HK$54.7 million). Net profit margin increased by 1.5 percentage points to 7.9% (1H 2023: 6.4%), with basic earnings per share at HK9.6 cents (1H 2023: HK6.6 cents), representing a 45.5% increase compared to the same period last year.

The Board has resolved to recommend the payment of an interim dividend of HK4 cents per share for the six months ended 30 June 2024, representing a payout ratio of 41.8%.

Outlook

Looking ahead to the second half of 2024, global economic activity is stabilizing and recovering. Since the beginning of the year, the consumer electronics industry has shown significant improvement. With inventory levels across the supply chain remaining healthy and AI technology driving consumer replacement demand, coupled with the traditional peak season in the second half, end-user demand for consumer electronics products is expected to rebound significantly. As brand owners actively prepare to launch new products, the Group's mold and plastics operations maintain full capacity utilization in the third quarter, and management remains cautiously optimistic about business development.

Mr. Li Pui Leung, Chairman of TK Group, said, "In line with our clients' industrial restructuring trends, the Group has successfully established an overseas production base in Vietnam. The 'China+Vietnam' production layout helps the Group adapt to the dynamic political environment, thereby enhancing our risk management capabilities. Furthermore, to address production bottlenecks in China, the Group not only flexibly allocates orders to our Vietnam facility but also leverages our strategic partners' production capacity in China to increase productivity promptly and effectively, ensuring operational flexibility to capture business opportunities." He added, "The Group is committed to strengthening our soft power to address rapidly changing macro conditions. We have consistently promoted industrial upgrading, and this year, in response to the national new productive forces strategy, we are utilizing data middle platform and AI technologies to further enhance process control, ensuring excellence in manufacturing processes, maintaining stability in high-precision production, and increasing the adoption of Industry 4.0 technologies to optimize processes, improve production efficiency, and continue driving cost reduction and efficiency improvements."

Mr. Yung Kin Cheung Michael, Chief Executive Officer of TK Group, added, "The Group remains dedicated to technological advancement and innovation, continuously enhancing our injection molding capabilities. We offer differentiated product solutions including integrated silicone and traditional injection molding technologies, and Printing Direct Structure (PDS) technology, providing more diverse high-end casing products for domestic and international brand clients and leading consumer trends. The Group is particularly optimistic about leading brands in innovative consumer electronics technology and medical sectors in China, aiming to leverage our years of experience and expertise in serving global technology leaders to help domestic clients expand into international markets." He further added, "The widespread adoption of AI technology has brought new opportunities to the consumer electronics industry. We expect overall market demand for consumer products to gradually expand, and the Group continues to deepen strategic partnerships with major consumer electronics brands."

Business Review for the First Half of 2024

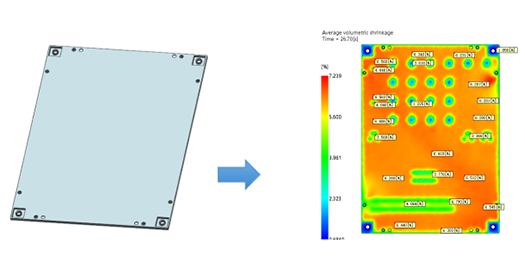

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises.

Revenue from the mobile and wearable device segment increased significantly by 51.2% year-on-year, driven by new product series launches from several wireless earphone and smart wristband brand clients, along with market inventory replenishment, leading to substantial growth in the Group's orders. Revenue from the commercial communication equipment segment surged by 44.2% year-on-year, as brand clients completed product recalls last year and launched new products during the Period with favorable market response. The smart home segment rose by 8.1% year-on-year, maintaining stable demand. Revenue from personal care brand clients resumed growth with an 18.2% year-on-year increase; revenue from brand clients in in-vitro diagnostics, blood glucose monitoring, hemodialysis, and other medical consumables increased significantly by 38.6% year-on-year; however, substantial fluctuations in orders from some smaller-scale medical consumables clients resulted in an overall 8.5% year-on-year decrease in revenue for the medical and personal care segment. Although revenue from the electronic vaporizer segment decreased by 7.1% year-on-year, based on clients' annual order requirements, revenue from this segment is expected to increase steadily.

Plastic Components Manufacturing Business (Approximately 73.3% of Total Revenue)

Revenue from the plastic components manufacturing business segment was approximately HK$738.3 million (1H 2023: HK$592.7 million), representing a 24.6% increase year-on-year. In the first half of 2024, the Group's injection molding business maintained robust orders and increased capacity utilization, offsetting some initial development investments in new products. The gross profit margin of the plastic components manufacturing business increased by 1.0 percentage point to 21.7% (1H 2023: 20.7%). The Group expects global inflation to continue to improve and consumer sentiment is expected to pick up more significantly in the second half of the year. Coupled with more aggressive order demand from customers and a certain number of new projects entering the mass production stage, the gross profit margin is expected to continue to improve.

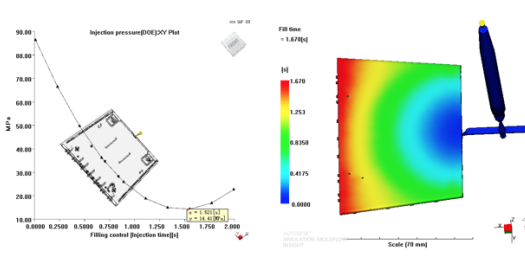

Mold Fabrication Business (Approximately 26.7% of Total Revenue)

During the first half of 2024, the revenue from external customers of the mold fabrication business amounted to approximately HK$268.9 million, representing an increase of approximately 2.1% as compared with approximately HK$263.2 million in the same period last year. With the continued recovery of the automotive industry and the revival of high-end consumer electronics and personal care sectors, along with brands redeploying new product launches and replenishing inventory, the Group's mold demand has recovered since late 2023 and maintained steady growth. Due to the longer production cycle of molds, segment revenue growth will gradually materialize. The Group's Industry 4.0 strategy implemented in recent years has proven effective, significantly enhancing production efficiency and market competitiveness, with segment gross profit margin increasing by 4.3 percentage points to 33.5% during the Period (1H 2023: 29.2%).