Hong Kong Main

Board Listing

Stock Code: 2283

TK Group (Holdings) Limited

(Stock Code: 2283)

Announces 2023 Annual Results

* * *

Revenue Reaches HK$1.95 Billion, Profit at HK$200 Million

Final Dividend of HK7.5 Cents, Special Dividend of HK10.0 Cents, Full-year Payout Ratio at 82.8%

Order Book Reaches HK$830 Million, Customer Portfolio Further Diversifies

Continuing to Deepen Presence in Advantageous Industries and Actively Expanding Domestic Business in 2024

The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283) announces its annual results for the year ended 31 December 2023 (the "Year").

In 2023, despite the global lifting of pandemic restrictions, economic growth faced multiple challenges, resulting in weak overall recovery momentum. Meanwhile, amid geopolitical uncertainties and reduced energy supply, prices and living costs remained high. Western major economies continued to raise interest rates to curb inflation, leading to sluggish end-user consumption demand. The consumer electronics industry consequently faced high inventory pressure, affecting order patterns from European and American consumer electronics clients, which in turn impacted the Group's performance. The Group's revenue for the full year of 2023 reached HK$1,945.7 million (2022: HK$2,279.3 million), representing a year-on-year decrease of 14.6%. Among which, the plastic components manufacturing business declined by 20.7% due to cooling overseas consumption demand, while the mold fabrication business recorded a 2.2% growth as global supply chains largely returned to normal.

Under weak economic conditions and reduced demand, clients continued to digest post-pandemic accumulated inventory, and new product production plans were delayed, forcing the Group to adjust production schedules, which affected production efficiency. Over the past two years, amid volatile external market conditions, the Group strengthened comprehensive optimization and improvement of production processes, striving to enhance efficiency and management effectiveness. The cost reduction and efficiency enhancement strategies have shown results. During the Year, the Group's gross profit decreased by only 5.3% to HK$512.8 million, with gross profit margin increasing by 2.7 percentage points to 26.4%. The Group's silicone product production base layout in Vietnam and Huizhou involved additional expenses, temporarily affecting profitability, and the Group recorded a profit of HK$204.2 million for the Year. Net profit margin increased by 0.5 percentage point to 10.5%. Basic earnings per share were HK$0.25.

The Board has resolved to recommend the payment of a final dividend of HK7.5 cents per share and a special dividend of HK10.0 cents per share for the year ended 31 December 2023. Together with the interim dividend of HK2.8 cents per share already paid, the full-year dividend totals HK20.3 cents per share, with the payout ratio increasing to 82.8%.

Business Review

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises.

In 2023, affected by factors including economic weakness, high inflation, and high interest rates, European and American consumers became more conservative in their spending, with significantly weak demand for electronic consumer goods and smart products during the Year. Additionally, brand clients were burdened by high channel inventory, leading them to undergo destocking and adjust product production and shipment plans, while postponing new product launches. The mobile and wearable device and smart home segments declined by 15.2% and 42.5% year-on-year respectively. Commercial communication equipment was affected by a large-scale product recall by brand clients during the Year impacting overall product sales volume, with revenue decreasing by 57.8% year-on-year. During the Year, revenue from medical clients recorded growth; however, under the dual pressure of high inflation and interest rates, global consumer sentiment remained low, causing the Group's personal care brand clients to reduce orders, directly leading to an 18.0% year-on-year decrease in the medical and personal care segment. Additionally, with favorable development prospects in the overseas electronic cigarette market and sustained demand growth, the Group's multi-cavity precision molds and high-efficiency injection molding technology gained recognition from overseas brand clients, resulting in a 63.4% year-on-year increase in revenue from the electronic vaporizer segment.

Plastic Components Manufacturing Business (Approximately 68.2% of Total Revenue)

Revenue from the plastic components manufacturing business amounted to approximately HK$1,326.1 million, representing a 20.7% decrease compared to the previous year. In 2023, the Group's injection molding business orders were impacted by market contraction, coupled with changes in product mix, resulting in a decrease in gross profit margin by 1.4 percentage points to 21.4% (2022: 22.8%). The Group expects that with continued improvement in global inflation, relaxation of economic tightening policies, and recovery in consumer spending in 2024, more active order volumes from customers and increased new projects will help improve capacity utilization, with potential for further margin improvement.

Mold Fabrication Business (Approximately 31.8% of Total Revenue)

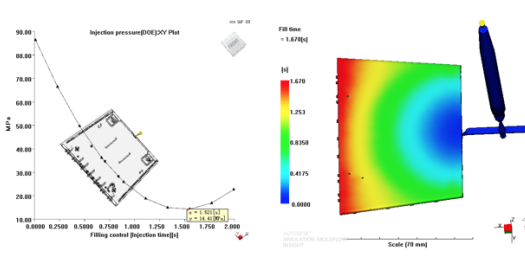

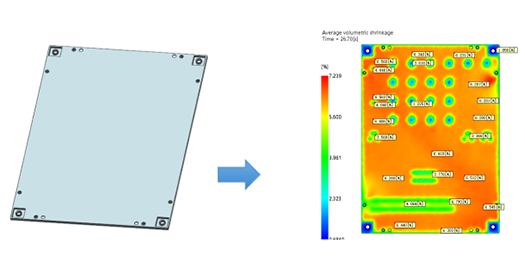

In 2023, revenue from external customers of the mold fabrication business amounted to approximately HK$619.6 million, representing an increase of approximately 2.2% from approximately HK$606.2 million in the previous year. Over the past two years, automotive production was constrained by pandemic control measures and shortages of semiconductors and components, impacting the automotive mold industry. As supply chains adjusted and shortages of key components such as semiconductors eased, the automotive industry moved towards recovery. The Group's mold orders have gradually recovered, and due to the longer production cycle of molds, segment revenue growth will materialize progressively. The Group's Industry 4.0 implementation in recent years has proven highly effective, greatly enhancing production efficiency and market competitiveness, with the mold fabrication segment's gross profit margin increasing by 10.6 percentage points to 37.0% in 2023 (2022: 26.4%).

Outlook

Looking ahead to 2024, economic growth still faces uncertainties, with variables affecting global recovery including monetary policies of major central banks in the US and Europe, and geopolitical risks such as the Russia-Ukraine war, Israel-Palestine conflict, and Red Sea tensions. As inventory destocking at the retail level for overseas consumer electronics products is nearly complete, and with products purchased during the pandemic reaching the end of their lifecycle, coupled with rapid development of artificial intelligence (AI) applications driving consumer electronics upgrades, the consumer electronics industry is expected to see strong recovery. The Group's domestic business continues to grow steadily. As Chinese enterprises successfully expand overseas, their heightened quality requirements and growing demand for high-precision plastic components and molds create significant opportunities for the Group. The Group is cooperating with brand owners in actively preparing new product launches and maintains a cautiously optimistic outlook for business development in 2024.

Mr. Li Pui Leung, Chairman and Executive Director of TK Group, said, "Diversification is TK's key to success, enabling us to maintain flexibility and agility in a changing market. As China's economy shifts towards high-quality and new technology development, we will focus on medical technology and innovative technology industries, more actively developing potential leading enterprise clients in China, thereby driving the Group's geographical market diversification." He also noted, "Meanwhile, we are exploring the establishment of another production base in North America, considering rapid injection molding capacity building through mergers and acquisitions or investments, to provide products and services with lower tariff costs to North American clients and further develop the North American market."

Mr. Yung Kin Cheung Michael, Executive Director and Chief Executive Officer of TK Group, added, "TK Group strives for excellence, with new product development integrating silicone and traditional injection molding technologies providing more diverse product solutions and enriching our product portfolio. We have also introduced new Printing Direct Structure (PDS) technology, complementing our existing mature IML process, multi-color material application technology, multi-cavity precision molds, and high-efficiency injection molding and automation technologies. This comprehensive capability enables us to provide diverse high-quality products that help our clients gain competitive advantages in the consumer market." He further added, "Management is reviewing various possibilities for extending the product value chain - providing one-stop services and convenience to clients while deepening our presence in advantageous industries and expanding our business footprint. This strategic approach aims to establish a more solid foundation for long-term development."