Hong Kong Main

Board Listing

Stock Code: 2283

Announces 2023 Interim Results

(Hong Kong - August 25, 2023) The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283), today announces its interim results for the six months ended 30 June 2023 (the "Period").

Over the past two years, amid uncontrollable macro environment fluctuations, the Group has focused on enhancing its capabilities and strengths, implementing cost reduction and efficiency improvement measures, and comprehensively optimizing and improving production processes to enhance production and management efficiency. During the Period, the Group's gross profit increased by 10.4% to HK$199.7 million (1H 2022: HK$180.9 million), with gross profit margin rising by 4.6 percentage points to 23.3% (1H 2022: 18.7%), showing initial results from cost reduction and efficiency enhancement initiatives. The Group continues to optimize its domestic and overseas production base layout, including silicone product production bases in Vietnam and Huizhou, which involved additional expenses. The Group recorded a profit of approximately HK$54.7 million for the Period (1H 2022: HK$58.5 million), representing a 6.4% decrease year-on-year. Net profit margin increased by 0.4 percentage point to 6.4% (1H 2022: 6.0%), with basic earnings per share at HK6.6 cents (1H 2022: HK7.0 cents), representing a 5.7% decrease year-on-year.

Business Review

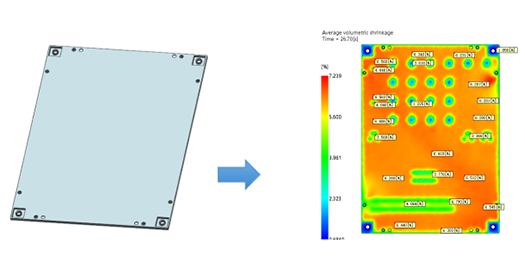

Due to various factors including high inflation in Europe and the United States and low consumer confidence, coupled with over-expansion of smart products and electronic consumer goods during the pandemic, product demand contracted significantly during the Period. With no strong signs of economic recovery, brand clients remained conservative in placing orders and delayed or adjusted their production and shipment plans. The mobile and wearable device and smart home segments decreased by 24.4% and 38.6% year-on-year respectively. Commercial communication equipment revenue decreased by 30.5% year-on-year due to the impact of a large-scale product recall by brand clients during the Period affecting overall product sales volume. The medical and personal care segment decreased by 18.4% year-on-year, primarily due to reduced orders from personal care brand clients amid weak consumer sentiment in Europe and the United States. However, utilizing precision multi-cavity mold technology, the Group has successfully developed several domestic medical clients, driving revenue growth from medical clients during the Period. Additionally, as electronic cigarettes continue to replace traditional products and overseas market demand accelerates, the Group's electronic vaporizer product technology has gained high recognition from overseas brand clients, with revenue increasing by 93.2% year-on-year during the Period.

Revenue from the plastic components manufacturing business was approximately HK$592.7 million, representing a 17.9% decrease year-on-year. In the first half of 2023, the Group's ongoing cost reduction and efficiency enhancement efforts began to show results, and together with falling raw material prices, the plastic components manufacturing business gross profit margin increased by 3.4 percentage points to 20.7% (1H 2022: 17.3%). The Group expects consumer sentiment to improve more significantly in the second half of the year, with increased order demand and new projects helping to improve capacity utilization and further enhance gross profit margin.

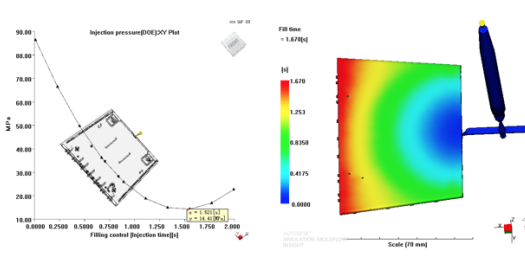

Revenue from external customers of the mold fabrication business amounted to approximately HK$263.2 million in the first half of 2023, representing an increase of approximately 6.5% from approximately HK$247.2 million in the same period last year. As shortages of key components such as semiconductors eased, the automotive industry showed gradual recovery in 2023, leading to progressive recovery in the Group's mold orders and growth in segment revenue. Moreover, following the completion of a series of cost reduction and efficiency enhancement measures over the past two years, the Group's mold business efficiency improved significantly, with segment gross profit margin increasing by 6.6 percentage points to 29.2% during the Period (1H 2022: 22.6%).

Looking ahead to the second half of 2023, the global economic outlook continues to face numerous challenges. With soaring living costs, middle-income American consumers are reducing spending due to difficulties in servicing existing debt, while general consumer price sensitivity has notably increased and consumption sentiment remains weak, causing brand owners to maintain a cautious procurement approach. Although the traditional peak season is approaching in the second half, our clients' order volumes show significant gaps compared to early-year projections, suggesting market conditions should not be viewed too optimistically as recovery will take time. In the second half, management will focus more on enhancing internal strengths and implementing cost reduction and efficiency improvement strategies to steadily navigate market challenges.

Mr. Yung Kin Cheung Michael, Chief Executive Officer of TK Group, added, "The Group focuses on expanding in domestic medical technology and innovative technology industries. Our medical business developed in recent years has gradually become a new growth driver, and we have begun business cooperation with a leading domestic bone conduction headphone brand, with successive product deliveries receiving enthusiastic market response. The Group also provides diversified product solutions through new products integrating silicone and traditional injection molding technologies. We are targeting the demand for light output capability in Mini LED display components, developing functional products incorporating silicone with first-mover advantage to address industry pain points and rapidly open up 'blue ocean' markets. In mid-August, the Group officially became a qualified supplier for a global leading Augmented Reality (AR) company, expecting more metaverse-related business opportunities in the future."