Hong Kong Main

Board Listing

Stock Code: 2283

Announces 2022 Annual Results

* * *

Revenue Reaches HK$2.28 Billion, Profit Approximately HK$230 Million, Final Dividend of HK8.6 Cents, Full-year Payout Ratio at 41.9%

Order Book Reaches HK$810 Million, Differentiated Diversification Strategy Shows Advantages

Focusing on Emerging Industries and Actively Developing Domestic Market in 2023

[Hong Kong - March 31, 2023] The world's leading one-stop plastics solutions provider - TK Group (Holdings) Limited ("TK Group" or the "Group", Stock Code: 2283), today announces its annual results for the year ended 31 December 2022 (the "Year").

2022 was a year full of turbulence and challenges. Since the COVID-19 outbreak, major economies including Europe and the United States adopted highly accommodative fiscal and monetary policies, while the Russia-Ukraine war catalyzed worsening inflation, leading to global economic slowdown and cooling consumer demand. The semiconductor supply shortage continued into the first half of 2022, with major automotive manufacturers and consumer electronics producers all lowering their annual production forecasts, making the business environment exceptionally challenging. However, the Group maintained stable revenue performance through its strong client relationships, diversified business segments, and continuous new product launches. The Group's revenue for 2022 reached HK$2,279.3 million (2021: HK$2,404.4 million), representing a year-on-year decrease of 5.2%.

New virus variants continued to impact global supply chains in the first half of 2022, with clients' production plans frequently disrupted by semiconductor shortages, forcing the Group to adjust normal production schedules and thus affecting production efficiency and gross profit margins. In contrast, the second half saw gradual improvement in semiconductor issues, with enhanced order stability and capacity utilization. The Group's profitability rebounded from first-half lows to levels comparable with the previous year's same period, driven by margin improvements from the introduction of new client products. During the Year, the Group's gross profit decreased by 4.9% to HK$541.3 million (2021: HK$569.2 million). Gross profit margin remained steady at approximately 23.7% (2021: 23.7%). Profit attributable to owners of the Company was HK$226.9 million (2021: HK$282.4 million), representing a 19.6% decrease year-on-year. Net profit margin decreased by 1.7 percentage points to 10.0% (2021: 11.7%), with basic earnings per share at HK$0.27, representing a 20.6% decrease year-on-year.

The Board has resolved to recommend the payment of a final dividend of HK8.6 cents per share for the year ended 31 December 2022. Together with the interim dividend of HK2.8 cents per share already paid, the payout ratio reaches 41.9%.

Business Review

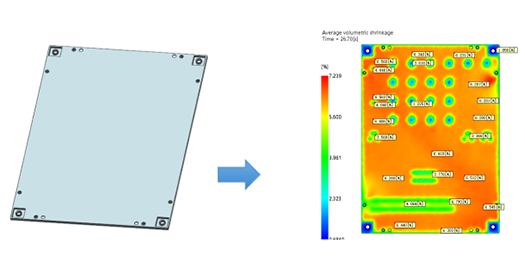

As a global leader in one-stop injection molding solutions, TK Group provides customized, cost-effective, and high-precision injection molding products and services to numerous internationally renowned enterprises. During the Year, the commercial communication equipment and electronic vaporizer segments of the downstream injection molding business showed outstanding performance, while the medical and personal care, and smart home segments maintained steady growth.

The smart home, medical and personal care segments achieved stable revenue growth, increasing by 7.7% and 3.6% year-on-year respectively. The Group has long focused on serving two leading global smart home brand clients, maintaining order growth during the Year. Having successfully developed several renowned domestic and international medical brand clients in areas including in-vitro diagnostics and blood glucose monitoring consumables, with mass production commencing during the Year, the Group will continue to develop clients in related industries to capture development opportunities in the medical and healthcare market. Revenue from the commercial communication equipment segment increased significantly by 72.1% year-on-year, driven by clients' successful business transformation and their continuous launch of new supporting products which were well-received by the market. Additionally, with the overseas electronic cigarette market experiencing rapid growth and steady demand increase, the Group's electronic vaporizer technology gained recognition from overseas brand clients, leading to a 27.0% year-on-year increase in revenue from the electronic vaporizer segment. Furthermore, the Group is developing new products incorporating silicone, providing innovative product solutions for various wearable personal products clients to further diversify its client portfolio.

Plastic Components Manufacturing Business (Approximately 73.4% of Total Revenue)

Overall revenue from the plastic components manufacturing business was approximately HK$1,673.1 million, representing only a slight decrease of 1.5% year-on-year. During the Year, order stability improved significantly in the second half compared to the first half, and coupled with the Group's rigorous strategy to enhance internal production efficiency, the gross profit margin of the plastic components manufacturing business increased by 0.6 percentage point to 22.8% (2021: 22.2%). The Group expects that with China's relaxation of pandemic prevention measures driving global economic recovery, more aggressive order volumes and new projects will help improve capacity utilization, with potential for further margin improvement.

Mold Fabrication Business (Approximately 26.6% of Total Revenue)

In 2022, revenue from external customers of the mold fabrication business amounted to approximately HK$606.2 million, representing a decrease of approximately 14.1% from approximately HK$706.0 million in the previous year. Over the past two years, the pandemic outbreak and escalating geopolitical conflicts caused supply chain disruptions, triggering a global semiconductor chip shortage crisis that severely impacted the automotive industry, affecting the Group's mold orders, particularly with increased machine idle time and wastage in the first half. Through a series of cost reduction and efficiency enhancement measures, the mold business efficiency improved significantly in the second half, with the mold fabrication segment's gross profit margin decreasing by only 0.7 percentage point to 26.4% for the full year 2022 despite continuous pressure from euro depreciation. As the automotive industry gradually recovered in the second half and demand for automotive lightweight products increased, the automotive segment's order book as of December 31, 2022, improved by 5.8% compared to December 31, 2021.

Outlook

While economic growth prospects remain overshadowed by factors such as the ongoing Russia-Ukraine war and intensifying geopolitical risks, global economic recovery is expected to accelerate as countries' inflation control measures show cooling effects and China reopens after three years of strict pandemic prevention measures, allowing economic activities to resume normal operations. Amid an uncertain business environment, the Group's diversification strategy demonstrates unique advantages, and while adhering to its steady progressive operational strategy, the Group continues to plan new growth initiatives despite economic fluctuations. Over the past few years, the Group has continuously explored emerging sectors and deepened its advantages in key industries. Meanwhile, the Group ensures technological leadership and continuously pursues comprehensive operational capability enhancement, improving overall competitiveness through advances in mold technology, product innovation, production efficiency, and internal management, strengthening and expanding its competitive moat to establish a solid foundation for long-term business development and continue creating value for clients and shareholders.

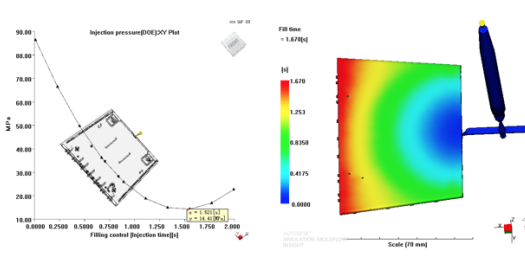

Mr. Li Pui Leung, Chairman of TK Group, said, "The Group remains optimistic about our five-year plan to double injection molding business sales from 2020 levels. China's strategy to expand domestic demand will create enormous market development opportunities. The Group's domestic expansion strategy responds to national policies, focusing on developing emerging industries in medical, smart home, and metaverse sectors. The Group will continue implementing its diversification strategy, deepening development in advantageous industries and actively exploring new quality business segments to ensure sustainable medium to long-term business growth." He also noted, "The Group will increase investment in precision mold business development. Currently, the Group possesses production capabilities for the highest precision MT1 molds, masters mature multi-color material application technology, and is equipped with high-efficiency multi-cavity precision molds, enabling us to customize cost-effective products according to client requirements. With China's continued economic growth and consumption upgrade, demand for high-quality, high-efficiency molds has reached a turning point. Additionally, new energy vehicles urgently require simplified structure and lightweight design. The Group's integrated injection molding process can support clients in simplifying assembly design to achieve lightweight structural components while effectively reducing production time and costs, enhancing client benefits."

Mr. Yung Kin Cheung Michael, Executive Director and Chief Executive Officer of TK Group, added, "The Group continues to develop LSR (Liquid Silicone Rubber) injection molding products that integrate silicone and traditional injection molding technologies, with our new facility in Huizhou increasing capacity to support growing client demand. Our newly developed production technology helps strengthen unique competitive advantages, consolidating our position as a global leading one-stop injection molding solutions provider, while significantly expanding future business growth potential. Furthermore, the Group's production base expansion plan is progressing orderly, with the first phase of our Vietnam injection molding facility successfully commencing production in late 2021, and the second phase construction underway to further expand capacity, helping the Group develop new clients in Southeast Asia and Europe/America while providing existing clients with supply options outside China." He further added, "Management continues to identify suitable acquisition or investment targets to accelerate business expansion and optimize our diversified commercial layout."